Contents:

It isn’t for everyone, and it’s important that you find a style that suits you. But if you’re tired of struggling with messy indicators and want a simple yet effective approach to the markets, this is it. Trading price action effectively is about reacting to what happens on the charts. You never want to try to outsmart the market by guessing what might happen. As long as the market is making higher highs and higher lows, it’s in an uptrend. Those momentum indicators give off a lot of false positives.

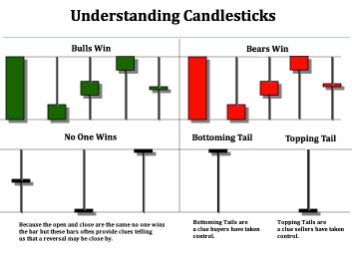

The way you have explained much information in short with ???????? This is one of those price action secrets that can make a huge difference and we have seen that many of our students have turned their trading completely around with it. Candles with a large body and small wicks usually indicate a lot of strength whereas candles with a small body and large wicks signal indecision. The rate with which the price rises during a trend is also of great importance.

How to Trade with Price Action Trading Strategies

The twenty period moving average is above the fifty period moving average . This meets part of the rules above for the forex price action scalping strategy. The next steps are to identify price action forex setups that develop in between the moving averages. The assumption is that the price will continue to move in the opposite direction to the tail, and traders will use this information to decide whether to take a long or short position in the market.

The ‘why’, is the reason you are considering to trade a specific market. Through your price action analysis, you will gain an edge on what is more likely to happen next – the market going up or down. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider.

Price Action Secrets Every Trader Should Know About

Even if you do decide to add some retracement levels or moving averages to your charts, try to talk yourself out of peppering your charts with half a dozen more indicators. All you will end up doing is complicating a method which functions through its simplicity. You also may end up with so many conflicting signals that you find yourself trapped in analysis paralysis more than find yourself trading.

When a security’s price is plotted over time, price action refers to the up and down movement of the price. Don’t hesitate and have the best trading experience with JustMarkets. Candlestick signals, and other trades will often form within these conditions, and may be tempting to trade – but are just too unreliable in an unstable market. This is the kind of ‘tunnel vision’ a lot of faster paced, lower time frame traders suffer from.

how to trade price action in forexrs use different chart compositions to improve their ability to spot and interpret trends, breakouts and reversals. Many traders use candlestick charts since they help better visualize price movements by displaying the open, high, low and close values in the context of up or down sessions. Price action traders focus on historical and current patterns to make money off where the price may head next. There have been many profitable price action traders, but it takes time to learn price action strategies, and spot trends, patterns, and reversals.

Getting Started With Forex Price Action

If https://g-markets.net/ trading at lower highs and lows, it’s trending downwards. Traders can use their knowledge of the sequence of highs and lows to choose an entry point at the lower end of an upward trend, and by setting a stop just before the previous higher low. If a price is on a clear downturn, with lower highs being consistently created, the trader might look to take a short position. If prices are rising incrementally, with the highs and lows trending increasingly higher, then the trader might want to buy in.

Do u think u could actually teach me how to trade without expecting a great deal of knowledge coming from me. I have found most sites expect a newbie to understand just about everything that they say. The unstable price action, and no clear market structure makes these types of charts very difficult to make money with. A lot of traders are very reluctant to move into lower time frames, due to a lot of misconceptions about trading on charts like the daily and weekly.

BreakOut Trading

Of course, the time period being used also has a huge influence on what traders see as a stock can have many intraday downtrends while maintaining a month-over-month uptrend. To be sincere, as a trader, price action gives me an edge over the market every time. And no other trading strategies I have ever seen comparable to the price action strategy. Therefore, any trader who really wants to make it big in this business has to learn this price action strategy wholeheartedly. Though the learning curve is long, but the end result is highly, incomparably and indisputably profitable.

For the formation to be formed in an ideal way, each bar needs to be entirely eclipsed by the one previous to it. None of the bars should protrude at all above or below the preceding ones. With an outside bar of either variety, you simply have a bar which is large enough that it contains the one which preceded it. If the previous bar is sticking out above or below it at all, you do not have a properly-formed outside bar.

If you were stuck in the mind-set of ‘trading a candlestick signal just because it’s there’, then you might take taken this. From the weekly time frame we gather the key information I would normally bring down to the trading time frame. Candlestick signal , averages out have about a 20% expected success rate – which in real life trading terms, is like jumping on the bankruptcy bus. But first, you need to master the charts, and become your own king of technical analysis.

USD/JPY Structure & Forex Trade Review 23th March 2023 – FXStreet

USD/JPY Structure & Forex Trade Review 23th March 2023.

Posted: Thu, 23 Mar 2023 20:28:23 GMT [source]

Do not deceive yourself by believing you will somehow succeed in currency trading without an appropriate and thorough knowledge of price action trading concepts. Therefore, be prepared with as much knowledge as possible. Do not forget that successful price action traders can become your best mentors – and that they can teach you some valuable lessons. Many traders have accomplished this, and occasionally they share their experience with novices. In other words, you can considerably reduce your learning curve, and also avoid a lot of trial and error by following the advice of skilled and proven price action traders. In addition to all of these rules, it is vital to explain the best way to trade price action in Forex.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

The first one is that you need to learn to master one price action Forex trading strategy at a time. By mastering one price action setup at a time, you will learn it inside out, and can then proceed to make it your own. A lot of traders jump from one strategy to the next without really giving each the full attention they require.

When you see a price pattern, ask yourself if you are really holding a stellar hand. Fundamental and technical analysis can become convoluted fast. Technical analysis is sometimes inaccessible to a beginner, and even someone with a college degree in economics to have a challenging time with fundamental analysis.